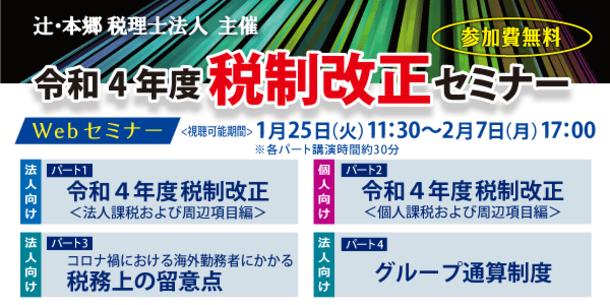

Genwa 4th year of tax reform, tax system to come into effect in 2022 | Tsuji / Hongo Tax Accountant Corporation

happy New Year.This year, we will also provide useful topics through tax topics.

The first tax topics this year explains the tax system in 2022 based on the 4 -year tax reform of the Order of the Order announced on December 10, last year.

Schedule until the tax system enforcement

There are various taxes such as corporate tax and income tax in Japan, but these tax systems are discussed, and the system is revised every year according to the social situation.The usual schedule is as follows.

| 9月 | 各府省庁より税制改正要望を提出 |

|---|---|

| 12月 | 与党税制改正調査会より税制改正大綱発表→閣議決定 |

| 1月~ | 財務省、総務省より改正法案を国会に提出→審議、法案成立 |

| 4月以降 | 新しい税制施行 |

Taxation revision of the 4th year of Towa

This year, on December 10 (Fri), the Liberal Democratic Party and the Komeito Party announced the "Tax Revision of the 4th Final".You can learn about the tax reform policy and specific contents of the 4th year of the Fourth Fourth from the tax reform.The following is a summary of what policies and what kind of tax system will be enforced in the 4th year of the Four Fiscal Fiscal Fiscal Fiscal Fiscal Fiscal Fiscal Fiscal Fiscal Fiscal Fiscal FY49ths.

For details on the content of the revised, please refer to the corporate "[Breaking News] Order 4 FY2022 (FY2022) Tax Revision Revision."

The keywords are "realizing a virtuous cycle of growth and distribution" and "development of a new society after corona"

The two keywords launched when the Kishida administration was launched in October 2021 is also reflected in this tax reform.Let's dig deeper into corporate taxation and personal income taxation.

Corporate tax tax

In the corporate tax, there was a review of the “wage -raising tax system” that promotes aggressive wages, and the “open innovation tax system”, which is collaborated by startup companies and existing companies.In addition, there was a review of the "5G introduction promotion tax system" from the viewpoint of revitalizing the region and accelerating network maintenance in rural areas.

Japan's wage level has been almost flat for over 30 years.

As a factor, compared to other developed countries, companies are reluctant to invest in investment, including human resources, and tend to focus on reducing costs and raising prices rather than innovation, reducing the scale of the whole economy.I'm in the situation.Therefore, for improving the situation, there is a background to create the following virtuous cycle.

After all, I think that it is the "wage -raising promotion tax system" that is expected to be used a lot.The wage -raising tax system is a system that allows you to deduct a certain percentage of the increased salary.

Whether or not to be applied is different between large and medium -sized enterprises.In the case of large companies, it is necessary to increase the salary of continuous employees to be applied.Among large companies, a certain number of corporations needed to declare management efforts in consideration of multi -stakeholders.

For a certain percentage of tax deduction, if the salary and education and training costs are increased, and the specified requirements are met, the number of tax deductions will be added to the increased salary.

Personal income tax

In personal income taxation, there was a review of "mortgage deduction" and "requirements for large shareholders, etc."

About reviewing mortgage deductions

Many people are worried about the revision of mortgage deductions.With a larger deduction amount than the loan repayment interest amount, the so -called reverse -Zaya state was regarded as a problem.With this amendment, the deduction rate is from 1 % to 0.The number of income is reduced to 7 %, and the income requirements will be less than 30 million yen to 20 million yen, which will be revised.

By 2050, in order to realize a carbon neutral that makes the greenhouse gas emissions as a whole, the cost of a highly energy -saving performance is increased, the mortgage deduction limit is increased, and the deduction period is 13 years.Is favored.

Regarding personal taxation, we aim to build a fair and neutral tax system in a work style without hindering the willingness to work, with the expansion of diverse and flexible working styles.

About reviewing requirements for large shareholders, etc.

It has been pointed out that high -income earners have been low in tax burden such as financial income.While the taxation of financial income is being reviewed, it is also necessary to take into account the environment where general investors are easy to invest, and in this revision, it will be a comprehensive listed stock.The judgment of large shareholders, such as dividend income, has been reviewed.

In addition, the property debt agency system, which was established in 2015 (2015), will be reviewed.Those who have over 1 billion yen in total assets will be subject to submitting property debt notes regardless of income.

Other electronic book book storage method, consumption tax

In addition to the above, the obligation to preserve electronic transactions under the Electronic Book Storage Law was scheduled to be enforced from January 1st, 4th, but a two -year grace period will be set up in a hurry.

In the consumption tax, the consumption tax eligible invoice (invoice system) will be enforced in October 2023.Registration for a qualitative invoice issuing company has already begun, and in 4 years, it is necessary to respond to the invoice system, such as registration to qualified invoices and formatting invoices.I have.

summary

There are various other items in addition to the above -mentioned tax reforms in Fourth Fourth.I hope you can see what will change.

執筆担当:北九州事務所 江原 里恵

![[EV's simple question ③] What is good for KWH, which represents the performance of the battery?What is the difference from AH?-WEB motor magazine](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_9/2022/3/9/b2506c4670f9f2cb45ffa076613c6b7d_0.jpeg)

![[How cool is the 10,000 yen range?] 1st: The performance of the "robot vacuum cleaner with water wiping function (19800 yen)" like Rumba is ...](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_9/2022/3/25/5251bb14105c2bfd254c68a1386b7047_0.jpeg)