Successful savings of 10 million yen in four and a half years! Instagrammer Setsuko's "Six Savings"

What is Setsuko's saving technique?

Setsuko -san (@setsuko_20)

関東地方で30歳の夫と3歳と0歳の息子と暮らす30歳の会社員。現在は2人目の育休中で、節約術や家計管理術についてInstagramで発信している。It was a typical "waste person" to use as much as there is money

――What made you want to start saving and starting household management?

Before the first childbirth, I became an imminent premature birth, and my income dropped dramatically.The childcare leave allowance I had rely on was more time than I thought until I was paid, and my husband's units of 170,000 to 200,000 yen alone would be in the red every month.It became a life of cutting down savings, and I started a sense of crisis if savings were running out, and started my household management and household improvement in earnest.

――What kind of money did you spend before you were conscious of saving?

At the beginning of the marriage, I was working together, so I used up all my pocket money.My husband often used it for clothes and expenses, and I often used it for beauty and expenses such as eyelash extensions and nails.

Looking back, I think at that time, we had prioritized "enjoying now" rather than saving for the future.I think, "I just need to do it now," and buy what you want and go where you want to go.Spending money was "stress relief", so there were many impulse buying.

Also, I used too many credit cards, I couldn't figure out how much I was using, and I was not aware that the fixed cost was high.

Survival of the practice, 6 points

――What did you start with when you started household management?

I started by checking the information that my household management account is transmitted on Instagram.If you search for "#household management" or "#household account book", you will get a lot of information.It was easier to refer to because you can see more realistic information than to check on the net.

For example, I created an Excel that is easy to use, referring to how to keep a household account book and the original household account book.

In addition, we collect ways to save money, reducing fixed costs, and various deals from Instagram.Looking at the real information, I thought, "I actually manage my household in this way!" "I can do it myself!"

――What kind of savings and household management are you currently managing?

There are six main ways to save me now.

By accumulating what I can do, I was able to save 10 million yen in four and a half years.

Save 900,000 yen a year by reviewing fixed costs!

――What are the ways to save money that you felt particularly effective?

It was very effective to review fixed costs.By changing my husband and my mobile phone to a cheap SIM, the mobile fee, which was 25,000 yen per month, was 2,500 yen a month.It was a 10/10 expenditure, and I was able to save 252,000 yen a year.

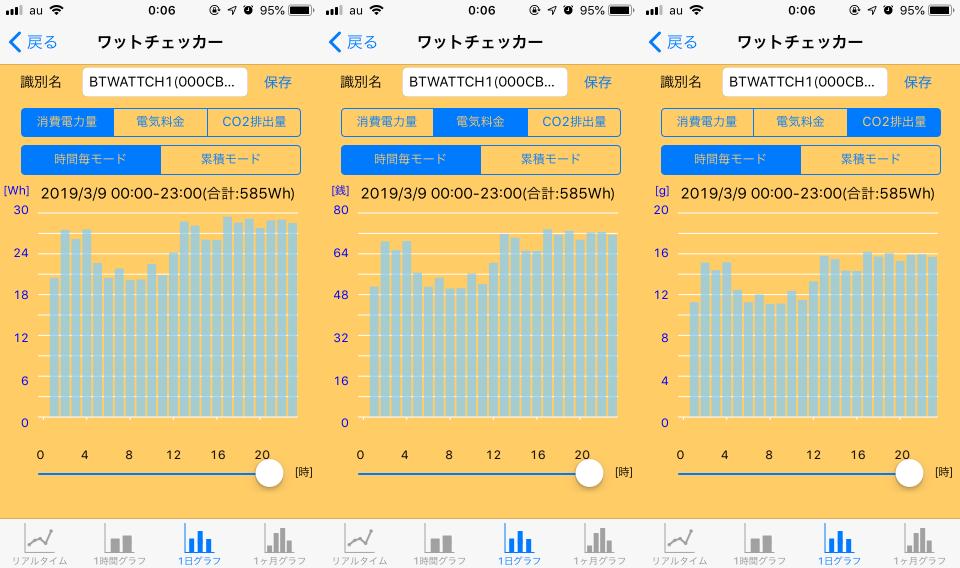

In addition, we redeemed a fixed cost of 480,000 yen a year by reviewing the insurance that my husband was in the bachelor, 144,000 yen a year, a leisure expenses that the whole family can enjoy by reducing pocket money.。Regarding pocket money, my husband is 10 % of the handling, I basically do not, and what I need is covered by my household budget.In addition, the utility bills have been reduced by 20,000 yen per year by changing the contract destination, and the introduction of water -saving shower for the water supply, which saves about 10,000 yen per year.

――It's a considerable amount of money!

Yes, the saved amount was 900,000 yen a year.Reviewing the fixed cost will lead to the surplus of the household.It takes time and effort, but once you review it, you'll get results later, so I'm glad I raised my heavy waist.

It's not painful if you save on you!

――Do you have the most important attitude and your own rules for saving?

I always try to think about what I manage my household.I decide that my family does not bother, so I manage my household for my family's smile, so I will not be stressed or saved.

For example, my home is a family who loves to eat, so I don't save food expenses.It is also great for health.

I also try to compare it with my past household, not my household.Depending on the area and environment, family structure, age, years of service, and annual income, how you can save is different for each home.Because it is different and natural, I do not compare my income and savings.

――Are there any difficulties that you are saving?

In the past, I thought it was painful many times, but each time I tried and error, I decided the rules as above.And I think the household account book and household management have been able to continue by finding a way that suits them.

The reason why household account books and household management do not last is that "the way does not suit me."I've never found a way to suit me and decides my rules.

――What do you want to tell those who are worried that you can't save?

I think everyone can do household management and savings.Four and a half years ago, there was also a time when her husband was 160,000 yen with her husband's power.The monthly savings were 280 yen.I was able to save 10 million yen at the start from 0.

If you don't know how to do it, imitate a person who is ready.There are many systems that lose if you do not know, such as funded NISA and hometown tax payment.And what you don't know is to find out.Instagram has a lot of useful and real information, and you can also ask the contributor directly.

And I think it's important to find a way that suits you and stack it steadily.Household management and saving will result in the more you do your best!

***

In four and a half years, I found that the reason for saving money from 0 to 10 million yen was the result of the efforts that Sekiko had continued the method that suits me.And the word "saving is not difficult now" remained very impressive.

The message that it is not difficult to continue in a way that suits you is encouraged.If you are interested, please take a look at Seetsuko's posts.

![[EV's simple question ③] What is good for KWH, which represents the performance of the battery?What is the difference from AH?-WEB motor magazine](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_9/2022/3/9/b2506c4670f9f2cb45ffa076613c6b7d_0.jpeg)

![[How cool is the 10,000 yen range?] 1st: The performance of the "robot vacuum cleaner with water wiping function (19800 yen)" like Rumba is ...](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_9/2022/3/25/5251bb14105c2bfd254c68a1386b7047_0.jpeg)