2021 How to write the end of the year -end adjustment <2> Illustrate how to calculate the deduction of life insurance premiums and the procedure for filling in the "deduction of salary income"

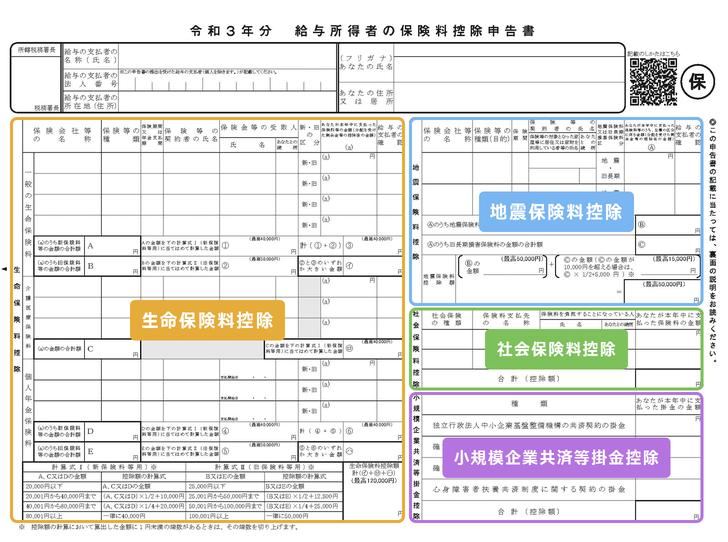

What is the "Deduction of Insurance Premiums for Salary Persons for 3 Years"?

The "Deduction of Insurance Premiums for Salary Person for 3 Years" is a tax return to declare the amount paid for life insurance and earthquake insurance and reduce the amount to be paid.Life insurance, which is the leading role, is classified into multiple classifications, and the formula that calculates the deduction amount from the insurance premium is a bit difficult to understand.

There are many people who continue as they are for life insurance once contracted.If you have a copy of the declaration written in the previous year, it is easy to fill in while looking at it if there is no change in the insurance contract.Of course, I would like to take a copy of the tax return I wrote this year or shoot with a smartphone and use it next year.

This declaration is divided into five blocks.The upper row is a column to fill in the company name, your name, address, etc.The large area on the left side of the lower row is life insurance.On the right is a column for filling in earthquake insurance, social insurance, defined contribution pensions, etc. vertically.

「令和3年分 給与所得者の保険料控除申告書」の5つのブロックThe top block is a column for filling in the company name, your name, and address.Probably, the jurisdiction of the jurisdiction, the company name, the corporate number, and the address of the company will probably be filled with the rubber mark at the time of distribution.In fact, if you fill in your name and address, you're done.

![[EV's simple question ③] What is good for KWH, which represents the performance of the battery?What is the difference from AH?-WEB motor magazine](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_9/2022/3/9/b2506c4670f9f2cb45ffa076613c6b7d_0.jpeg)

![[How cool is the 10,000 yen range?] 1st: The performance of the "robot vacuum cleaner with water wiping function (19800 yen)" like Rumba is ...](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_9/2022/3/25/5251bb14105c2bfd254c68a1386b7047_0.jpeg)